Securities class actions, powered by administrative law, are a pivotal tool in holding businesses accountable for securities fraud, shaping industry ethics, and promoting transparency in highly regulated markets. The intricate relationship between administrative bodies and financial regulations profoundly influences business operations, especially in white-collar sectors. Companies must navigate complex legal landscapes, implementing robust internal controls and risk management strategies to mitigate regulatory risks and foster stakeholder trust, ultimately ensuring long-term success.

Securities Class Actions: Unraveling the Complex Web of Regulatory Litigation

In today’s dynamic financial landscape, understanding securities class actions is paramount for businesses and investors alike. This comprehensive guide delves into the intricacies of these legal battles, focusing on the evolving role of administrative law in shaping securities litigation. We explore how regulatory frameworks impact businesses, navigating a complex legal tapestry to mitigate risks and ensure compliance. By examining real-world cases, we offer insights into the far-reaching implications for companies operating within the financial sector.

- Understanding Securities Class Actions: A Comprehensive Overview

- The Role of Administrative Law in Shaping Securities Litigation

- Implications for Businesses: Navigating the Complex Landscape

Understanding Securities Class Actions: A Comprehensive Overview

Securities Class Actions are a significant legal mechanism with a profound impact on how businesses operate in the financial sector. At their core, these actions involve groups of investors joining forces to take legal action against entities that have engaged in securities fraud or other misconduct. Understanding this process is crucial for navigating the complex landscape of administrative law that governs businesses, especially in today’s highly regulated financial markets.

The impact of administrative law on businesses is undeniable, and class actions play a pivotal role in ensuring corporate accountability. When investors collectively pursue legal recourse, it can lead to substantial settlements or verdicts that not only compensate victims but also send a powerful message throughout the industry. For his clients facing such charges, having a comprehensive understanding of their rights and the potential outcomes is essential for making informed decisions. Moreover, this process fosters transparency and encourages businesses to uphold ethical standards within the philanthropic and political communities at large.

The Role of Administrative Law in Shaping Securities Litigation

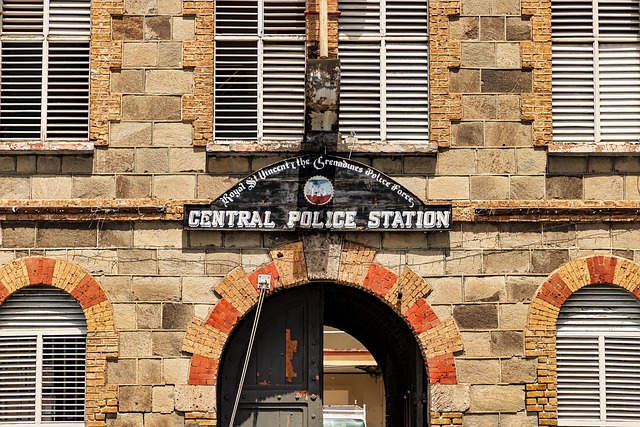

The role of administrative law in shaping securities litigation cannot be overstated. Regulatory bodies and administrative agencies play a pivotal role in ensuring fair market practices and protecting investors. By enforcing rules and regulations set forth by securities authorities, these institutions significantly impact the landscape of business operations, particularly for companies involved in white-collar activities. The impact of administrative law on businesses is profound; it sets the standards for transparency, accountability, and ethical conduct in the financial sector.

In many cases, administrative law serves as a crucial element in resolving disputes related to securities fraud and misconduct. When regulatory bodies investigate and take action against companies or individuals suspected of illegal activities, it can lead to significant legal consequences. This includes winning challenging defense verdicts for his clients who find themselves at the mercy of such proceedings. Ultimately, the interplay between administrative law and securities litigation fosters a culture of compliance and accountability, reshaping business strategies to prioritize ethical practices in the financial realm.

Implications for Businesses: Navigating the Complex Landscape

The impact of Administrative Law on businesses, particularly in the context of securities class actions, presents a complex landscape to navigate. As regulatory scrutiny intensifies, companies must meticulously manage their operations to ensure compliance with evolving rules and guidelines. This involves a deep understanding of the legal framework governing securities, consumer protection, and fair business practices. The intricate web of regulations requires businesses to implement robust internal controls and risk management strategies.

Securities class action lawsuits, often involving high-stakes cases and complex financial matters, demand meticulous attention to detail. Winning challenging defense verdicts for his clients relies on a comprehensive grasp of administrative law principles. Businesses must proactively identify potential legal pitfalls, stay informed about regulatory changes, and adapt their strategies accordingly. This proactive approach not only helps in avoiding costly legal battles but also fosters trust and transparency with stakeholders, ultimately enhancing long-term sustainability and success.

Securities class actions, while complex, are navigated through a intricate interplay of legal frameworks, with administrative law playing a pivotal role. Understanding this dynamic, particularly the impact of administrative law on businesses, is essential for companies aiming to mitigate risk and ensure compliance in today’s regulated financial landscape. By grasping these nuances, businesses can better prepare for potential litigation, foster transparency, and ultimately protect their interests.